• If conditions in the energy sector get worse, this could have downside risk on confidence, employment and wages, creating persistent oversupply and steeper-than-expected price declines in the housing market.

• Signs of supply adjustments are present in the market. If the downside risk is averted, then the amount of oversupply should start to ease by the end of the year. • Unless the Canadian economy underperforms, further rate increases are expected in 2019. This will impact housing demand

• If new-home inventories and product under construction do not ease, this will prolong buyers’ market conditions in the housing market.

• Provincial and federal elections could result in changes to government spending, policies and confidence in the market.

• For those considering ownership, further resale price declines can make the resale market more attractive to purchasers compared to new homes.

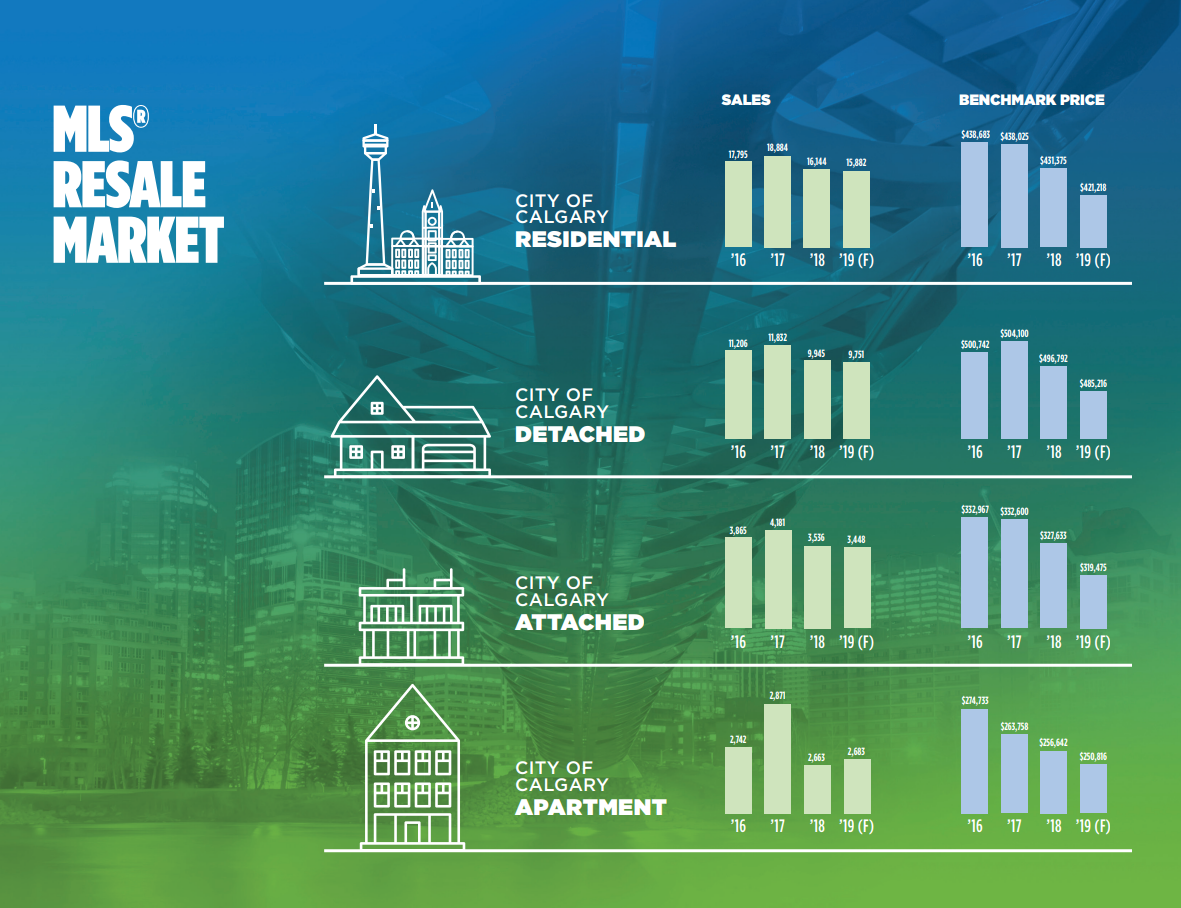

The challenging economic climate in Calgary is expected to persist into 2019. While there was some evidence of stabilization in the energy sector in early 2018, issues surrounding the price differential of oil, falling global prices, a lack of market access and ability to attract investment are placing current and future growth at risk. The economic impact of recent events is not expected to translate into another recession in 2019. However, it will impact employment opportunities, consumer confidence and the housing market.

On top of energy sector concerns, we are in an environment of stricter lending conditions and higher interest rates. The Canadian economy is growing, supporting further expected gains in interest rates in 2019. Higher rates and stricter requirements come at a time when the Alberta economy still struggles with employment and wages. With further rate increases expected in the second half of 2019 and no significant improvements in the job market, resale sales activity is forecasted to remain low compared to historical standards.

Please read the full report here.