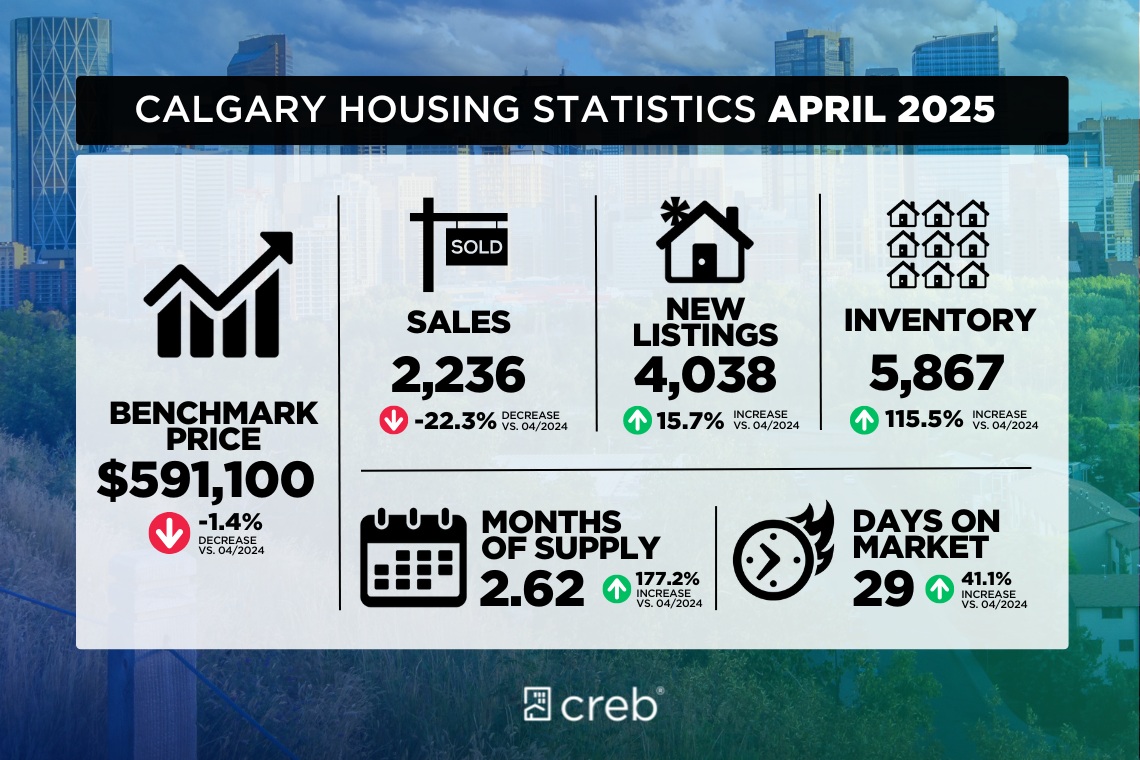

A boost in new listings this month relative to sales caused April inventories to rise to 5,876 units. Although this is more than double the number reported last year, last year’s supply was exceptionally low, and current inventory levels are consistent with what we typically see in April. April sales reached 2,236 units—22 per cent below last year’s levels but in line with long-term trends.

“Economic uncertainty has weighed on home sales in our market, but levels are still outpacing activity reported during the challenging economic climate experienced prior to the pandemic,” said Ann-Marie Lurie, Chief Economist at CREB®. “This, in part, is related to our market's situation before the recent shocks. Previous gains in migration, relatively stable employment levels, lower lending rates, and better supply choice compared to last year’s ultra-low levels have likely prevented a more significant pullback in sales and have kept home prices relatively stable.”

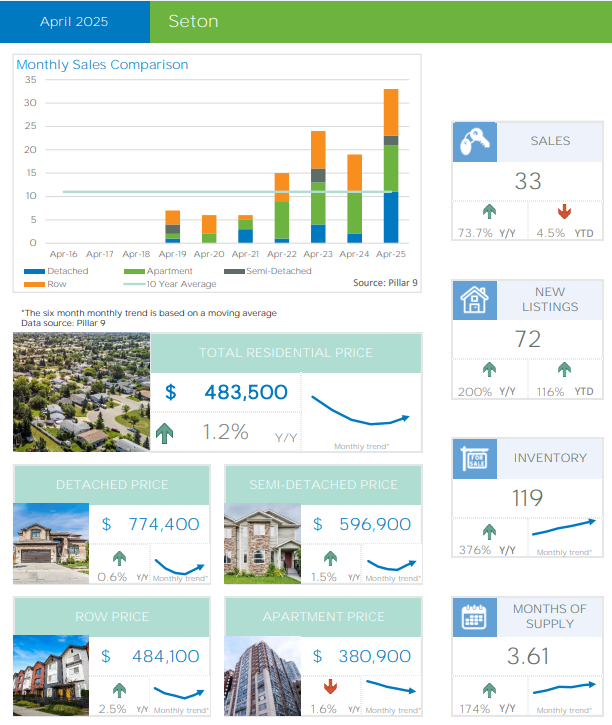

The rise in inventory levels helped the market shift to balanced conditions with nearly three months of supply. However, conditions vary depending on price range and property type. Lower-priced detached and semi-detached properties continue to struggle with insufficient supply, while row and apartment-style homes are seeing more broad-based shifts to balanced conditions.

The additional supply has helped relieve the pressure on home prices following the steep gains reported over the past several years. Benchmark prices for each property type have remained relatively stable compared to last month. However, compared to last year, detached and semi-detached prices are over two per cent higher than last year's levels, while apartment and row-style home prices have remained relatively unchanged.

Detached

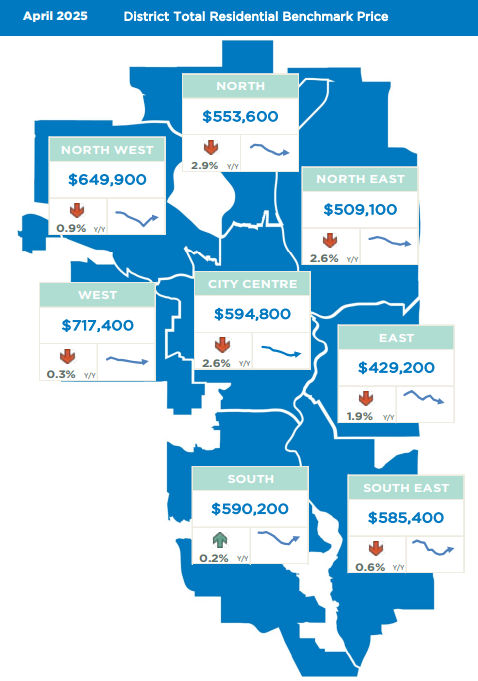

Detached sales were 1,102 units in April, a year-over-year decline of 16 per cent. While sales eased across most areas of the city, the South East district has seen sales rise over last year's levels. April saw 1,907 new listings come onto the market, and the sales-to-new-listings ratio remained balanced at 58 per cent. Inventories rose to 2,511 units, and the months of supply rose to 2.3 months. While this is a significant gain over the less than one month of supply reported last year at this time, conditions remain relatively tight, especially in the lower price ranges.

In April, the unadjusted benchmark price reached $769,300, similar to last month but over two per cent higher than last April. The added supply choice, combined with uncertainty, has slowed the pace of price growth. However, with a year-over-year gain of nearly five per cent, the City Centre has exhibited stronger price growth than any other district.

Semi-Detached

Easing sales in April contributed to the year-to-date decline of nearly 16 per cent. The 190 sales in April were met with 350 new listings, and the sales-to-new-listings ratio fell to 54 per cent. This also caused further gains in inventory levels, which reached 484 units. The rise in inventory did help push the market toward balanced conditions with 2.6 months of supply, a significant improvement over the less than one month reported at this time last year.

The shift toward more balanced conditions has slowed the pace of price growth. In April, the unadjusted benchmark price was $691,700, similar to last month and over three per cent higher than last year. The City Centre reported the largest gain, at over five per cent, while prices in the North remained stable compared to last year.

Row

April sales slowed for row homes, contributing to the year-to-date decline of 16 per cent. Meanwhile, new listings continued to rise compared to last year, driving the sales-to-new-listings down to 51 per cent. In April, inventories reached 1,005 units, the highest level reported since 2021, and the months of supply rose to nearly three months. Improved supply has taken some of the pressure off prices,

In April, the unadjusted row price was $457,400, a slight gain over last month, but relatively unchanged compared to April of last year and still below last year's peak price reported in June. The pullbacks reported in the North and North East districts offset year-over-year gains in most districts.

Apartment Condominium

April sales eased by nearly 30 per cent over last year's record high but were far stronger than long-term trends. While sales have remained relatively strong, new listings in April reached a record high for the month, supporting further gains in inventory levels. With three months of supply in the city, conditions are considered relatively balanced. However, activity does range significantly based on location, impacting price movements.

The North East district reported the highest months of supply at seven months, resulting in a year-over-year price decline of two per cent and a spread of over seven per cent from last year's high. Overall, the April benchmark price in the city was $336,000, similar to last year but still three per cent lower than last year's record high.

REGIONAL MARKET FACTS

Airdrie

For the third month in a row, sales activity eased compared to last year's levels. Despite the declines, sales remain above long-term trends. At the same time, new listings continue to rise, but with 185 sales and 290 new listings in April, the sales-to-new listings ratio reached 64 per cent, an improvement over recent months. Inventory levels continued to trend up this month. However, after three consecutive years of exceptionally low April levels, inventory is now consistent with long-term trends. With 2.3 months of supply, conditions are moving to a more balanced state, taking the pressure off home prices. In April, the total residential price was $544,700, relatively unchanged compared to both last month and last year's levels.

Cochrane

For the fourth month in a row, sales activity in the area has remained consistent with last year's levels, resulting in 335 sales so far this year, a nearly five per cent gain over last year and consistent with long-term trends. New listings have also been on the rise, but the sales-to-new-listings ratio has remained at 60 per cent, preventing the doubling of inventory in this market. While inventory levels have improved compared to last year, the 246 units available in April are just shy of long-term trends. Like other areas, improvements in supply have slowed the pace of price growth, but in Cochrane, prices are still edging up. In April, the total residential benchmark price was $592,000, trending up over last month and nearly six per cent higher than prices reported in the previous year and at a record high.

Okotoks

Sales in Okotoks continue to ease compared to last year, contributing to the year-to-date decline of 16 per cent. Over the past few years, sales have been restricted by a lack of supply. However, this year we have started to see a shift. New listings continue to improve in April compared to sales, causing the sales-to-new-listings ratio to ease to 53 per cent, supporting inventory gains. However, with 127 units in inventory in April, levels remain below long-term trends for the month. The modest gains in inventory have slowed the pace of price growth in the area. As of April, the unadjusted benchmark price was $627,100, down slightly from last month, but nearly two per cent higher than last April.

Contact us for a Free Home Evaluation.

For latest community market report, SIGNUP HERE.