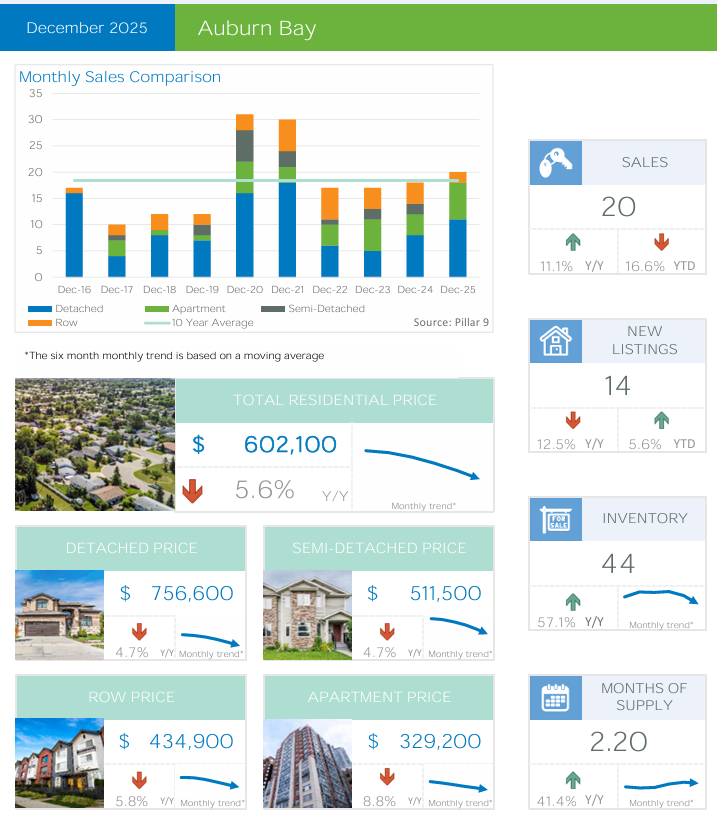

December wrapped up with 20 sales in Auburn Bay — an 11.1% increase year-over-year, though year-to-date totals remain 16.6% lower than 2024 as sales softened through fall. Inventory rose to 44 units (+57.1% Y/Y), pushing months of supply to 2.20, shifting conditions toward balance. 14 new listings entered the market (-12.5% Y/Y), helping slow further inventory buildup.

Prices continued to adjust from peak levels. The residential benchmark price moved to $602,100 (-5.6% Y/Y), with all property types trending downward on both annual and short-term measures:

Detached: $756,600 (-4.7% Y/Y)

Semi-Detached: $511,500 (-4.7% Y/Y)

Row: $434,900 (-5.8% Y/Y)

Apartment: $329,200 (-8.8% Y/Y)

The six-month trend signals continued mild downward pressure as the community transitions from the post-pandemic seller’s market to a more balanced environment heading into 2026.

Schools & Education

Auburn Bay offers a full school pipeline for local families, including:

Auburn Bay School (K–4)

Lakeshore School (5-9)

Prince of Peace School (K-9, Catholic)

Joane Cardinal-Schubert High School (in adjacent Seton)

The easing of enrollment pressures through 2025, combined with planned catchment adjustments in surrounding communities, continues to stabilize demand for family housing.

Local Development & News

The broader Seton/Auburn Bay corridor remains one of Calgary’s highest-growth districts. Notable updates include:

Continued retail expansion in Seton Market and Auburn Station

Improved pedestrian integration between the lake community and the South Health Campus

Ongoing housing diversification, with more row and apartment product supporting affordability

Continued discussion around future transit connectivity and cycling infrastructure

These additions support value long-term even as pricing recalibrates in the near term.

With balanced supply, stabilizing demand, and more diverse product types coming to market, Auburn Bay is positioned for a measured and sustainable 2026. Buyers gain negotiating power and choice, while sellers benefit from strong community fundamentals, amenities, and lifestyle advantages that continue to draw families into the southeast.